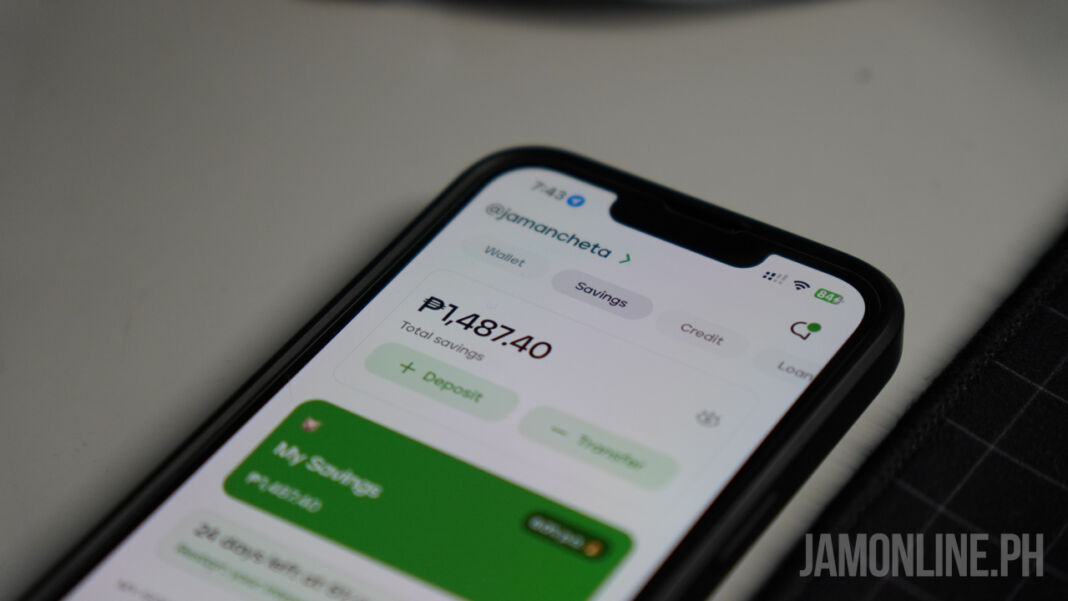

Managing your finances is a lot easier when you have separate accounts for savings, expenses, bills, emergency funds, travel funds, and more. For instance, when Maya rebranded and announced its new Maya Savings feature, we started using it for our money goals.

Overall, we’re happy with our experience with Maya Savings, and we’d like to share why we intend to achieve our 2023 money goals using it.

#1 REASON WHY WE CHOOSE MAYA SAVINGS: HIGH-INTEREST SAVINGS RATE THAT WE RECEIVE DAILY

When we started using Maya Savings, we enjoyed an already high 4.5% savings interest rate per annum, which we enjoy daily. But for another 30 days, we’re already able to grow this interest rate to 6% by simply using Maya for our everyday transactions.

You can experience this, too, and watch your savings grow even more! It’s simple. When you open a Maya Savings account, spend an accumulated amount of Php250 when paying for your purchases via Maya QR, card, or mobile number. You can also pay your bills or buy prepaid load via the Maya app to increase your interest rate per annum, which you can receive daily in your savings.

Start your journey today with Maya, as this promo is available only until February 28, 2023.

#2 REASON WHY WE CHOOSE MAYA SAVINGS: IT’S SAFE AND SECURE

Since its relaunch, Maya promised to become Filipinos’ “everything and a bank,” with Maya Bank. This makes it easier for ordinary Filipinos to manage their finances safely.

Unlike other banking institutions, you don’t need a maintaining balance or a minimum amount of money to save on Maya. This makes dreaming of financial freedom a lot more affordable and accessible. And, of course, minus the paperwork you need to do when opening a savings account at banks, Maya offers the same service as other financial institutions, especially when Maya is also a BSP-licensed bank. With this, you can be confident that your hard-earned savings are safe and secure.

In addition, Maya delivers a 99.9% uptime rate, so we never really experience having trouble accessing our account. We can’t recall a time when we needed to send money or pay bills using Maya only to find out that their service is down at the moment. This gives us a seamless banking experience, ensuring that we can access our money whenever or wherever.

#3 REASON WHY WE CHOOSE MAYA SAVINGS: FINANCIAL MANAGEMENT MADE EASY

Achieving your 2023 money goals with Maya will be fun and easy—thanks to its features that make money management feel like a good time.

For instance, when we started using Maya Savings, we also set our Personal Goals – with a guaranteed 6% interest rate per annum. Then, the app allowed us to divide our savings into different categories based on unique purposes, such as savings, travel, and emergency funds. Hence, we can easily track how near we are to achieving our money goals in a single glance on the app.

#4 REASON WHY WE CHOOSE MAYA SAVINGS: SETTING IT UP IS AS EASY AS 123

One of the great things about saving money using Maya is its easy process. All you need to do is upgrade your Maya wallet account.

You don’t even have to worry about maintaining a minimum balance, compared to other financial institutions where you need to keep a minimum of Php3,000 or more just to keep your account active.

In addition, transferring money from our Maya account to other banks/financial institutions is also seamless and free via PesoNet. So, now that the season of giving is just around the corner, ensure that you transfer funds via your Maya account.

#5 REASON WHY WE CHOOSE MAYA SAVINGS: WE EASILY GOT OUR VISA-POWERED ATM CARD

Of course, there were also times when we needed to withdraw our money from our Maya account. Good thing, apart from having a virtual card, we also have a VISA-powered ATM card, which is integrated into our Maya account. With this, we can easily access and withdraw our money when outside and need to pay in cash.

Here are the easy steps on how you can get a FREE ATM card from Maya:

– Download the Maya app to create your account

– Prepare one valid ID to upgrade your account

– On your savings dashboard, open a Maya Savings account

– Order a Maya card with your @username, and get Php200 cash back.

Learn more about this at this link. Tip: Stay tuned this Feburary for more ways to get FREE Maya Card!

#6 REASON WHY WE CHOOSE MAYA SAVINGS: IT HELPS US BUILD GOOD CREDIT SCORE

Meanwhile, if you want to build a good credit history for your future expenses, like a car, home, and more, then, having a Maya Savings account can help! This is exciting, considering every transaction we do using our Maya account helps us build a good credit score.

In addition, Maya also offers eligible customers an instant revolving credit of up to Php15,000, which you can use in your Maya Wallet or transfer to your Maya Savings.

Want to achieve your 2023 money goals?

Download the Maya app now and start your 2023 money goals!

Visit maya.ph or follow @mayaiseverything on Facebook, Instagram, TikTok, and YouTube, and @mayaofficialph on Twitter to discover why you should start saving money using Maya. You can also join their Telegram community at this link to read why more and more Filipinos choose to bank with Maya.